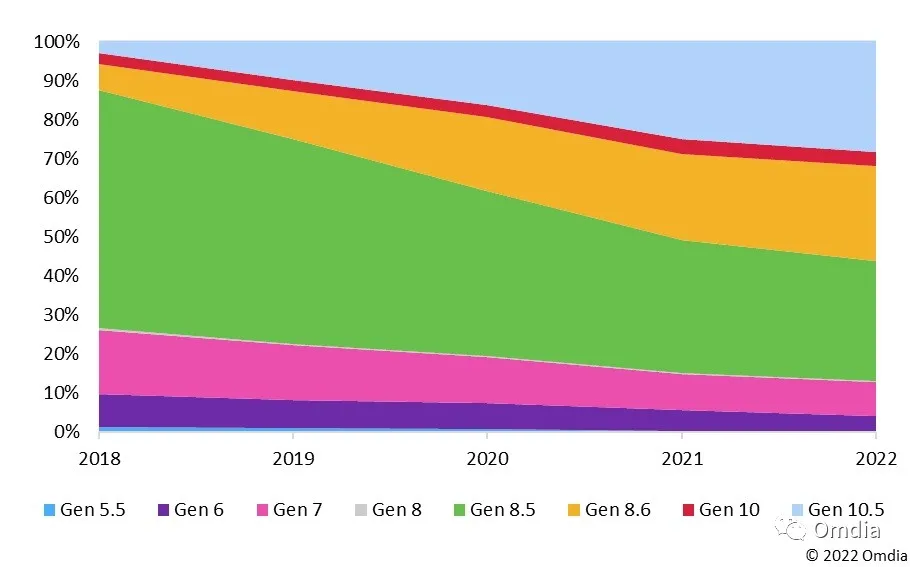

According to a report released by Omdia, in 2022, the proportion of TV panels produced on Gen 8.5 and 8.6 lines will be reduced to 60%, while more than 30% of TV panels will be produced by Gen 10 and Gen 10.5 lines. Panel makers will continue to make the following adjustments in their panel production lines:

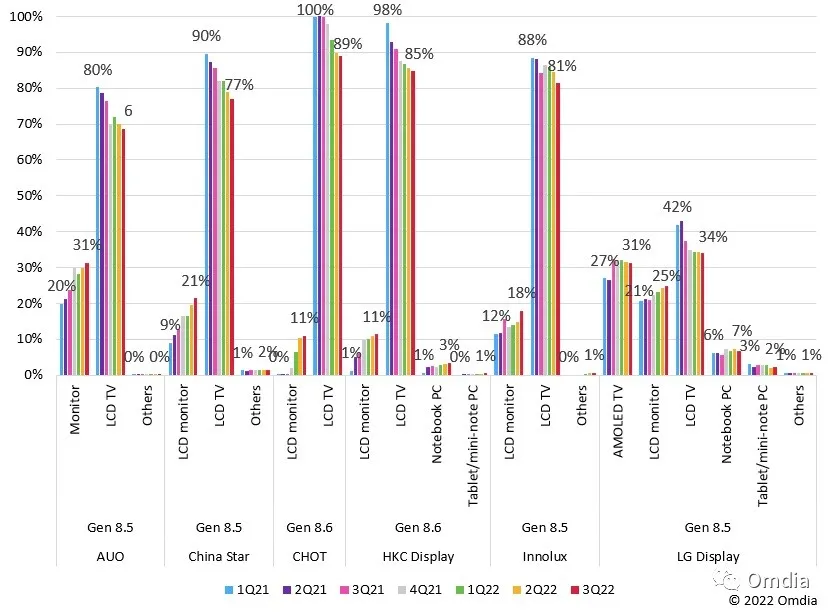

Panel makers continue to shift the production of IT panels, including notebook, desktop monitor panels, and larger size tablet panels, to Gen 8.5 (2200x2500 mm) and Gen 8.6 (2250x2600 mm / 2250x2620 mm) production lines.

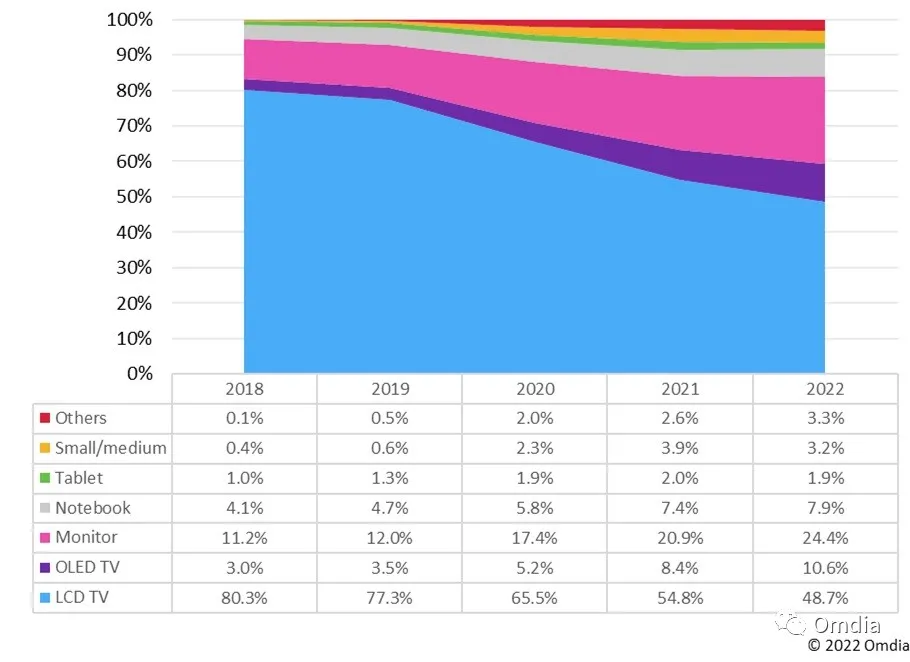

LCD TVs, once the most important product in the Gen 8.5 panel production line, will shrink to less than 50% of the total output of the Gen 8.5 and 8.6 lines by 2022. This figure is 54.8% in 2021. With new technologies such as metal oxides (IGZO), GOA (gate on the array), high resolution, ultra-thin glass substrate processing, and IPS wide viewing angle, panel makers continue to have new and improved capabilities in their Gen 8.5 and 8.6 panel production lines. Advanced functional laptop and desktop monitor panels.

- In 2021, 28.8% of TV panels will be produced on Gen 10 and Gen 10.5 lines; in 2022, this proportion will rise to 31.8%.

- In 2021, 22.1% of TV panels will be produced by Gen 8.6 lines; in 2022, this proportion will rise to 24.5%.

- In 2021, 34% of TV panels will be produced by Gen 8.5 lines; in 2022, this proportion will drop to 30.8%.

- In 2021, 9.4% of TV panels will be produced by Gen 7 and 7.5 lines; in 2022, this proportion will drop to 8.9%.

- In 2021, 54.8% of Gen 8.5 and Gen 8.6 line capacity will be used for LCD TV panel production; in 2022, this figure will drop to 48.7%.

- In 2021, 8.4% of Gen 8.5 and Gen 8.6 line capacity was devoted to OLED TV panel production; this figure will rise to 10.6% in 2022 as LG, the sole supplier of WOLED shows ambitious plans.

- In 2021, 20.9% of Gen 8.5 and 8.6 line capacity is dedicated to desktop display panel production; this proportion will rise to 24.4% in 2022.

- In 2021, 7.4% of Gen 8.5 and 8.6 line capacity is devoted to notebook PC panel production; in 2022, this proportion will increase to 7.9%.

0 Comments