Shubham Mazumdar is a well-known doctor in Los Altos, Silicon Valley. Outside of work, his biggest hobby is digital devices, especially playing with various smartphones, and that's how we met. As a senior "machine friend", according to his own introduction, in the past ten years, he has bought seven or eight smartphones almost every year.

But unlike other U.S. digital enthusiasts, Mazumdar especially favors Chinese smartphones. He is a die-hard Android fan, but he doesn't like Samsung very much. There are too few choices in the US market. Chinese smartphones have opened up another world for him. Over the years, the Chinese smartphones he has purchased include OPPO, vivo, Xiaomi, Huawei, Honor and many other brands.

"Chinese mobile phones have brought me a variety of choices, not only the products are very cost-effective, but also have many user-friendly functional details, such as dual-opening apps and camera scanning functions, etc. There are too few choices for Android phones in the United States, Google Pixel 6a ( The price is $450 before tax, which is equivalent to more than 3,000 yuan. The screen is still 60hz refresh rate, and other parameters such as the camera and screen of the motorcycle phone are mediocre.” He explained his preference for Chinese smartphones.

In order to buy the newly released flagship smartphones in China, Mazumdar always buys online, or invites Chinese relatives and friends in the United States to carry them along, because some domestic mobile phones are only sold in China, and there is no international version of ROM. In the past two years, the passage between China and the United States has been difficult, and he has also lost the channel to buy human flesh. (His wife is Chinese.)

Mazumdar struggled to buy Chinese smartphones, of course, because these phones were not available in the United States, and he could not buy these Chinese phones from official channels (except for the OnePlus listed in the United States). As he said, due to the collective lack of Chinese smartphones, American consumers have only a handful of other mid-to-high-end mobile phones to choose from, apart from Apple and Samsung, and "machine friends" who want to play Android can only look for Chinese smartphones on the Internet. .

$75 billion in annual revenue

How big is the U.S. smartphone market? Statistics from Statista show that the U.S. smartphone market peaked in 2018, when the market size totaled $79.1 billion and shipments totaled 163 million units. While there was a slight dip in subsequent years, 2021 saw a marked recovery following the outbreak.

Last year, the total US smartphone market revenue was US$74.7 billion, a year-on-year increase of 2.3%; shipments totaled 147 million units, a year-on-year increase of 6%. It is worth mentioning that the average sales price of the US smartphone market exceeded $500 last year, indicating that this is a mature market dominated by mid-to-high-end mobile phones.

In comparison, the Chinese smartphone market according to IDC will ship 329 million units in 2021, a year-on-year increase of 1.1%. India's smartphone market shipped 161 million units last year, up 7% year over year. The United States has a population of about 350 million, a quarter of that of China and India.

According to eMarketer, the share of the U.S. population with a smartphone has grown from 31% to 88% over the past decade, reaching saturation. 96% of young adults aged 18-49 already own a smartphone. Among the middle-aged and elderly people aged 50-64, 83% of the population owns a smartphone. 61% of people over the age of 65 own a smartphone.

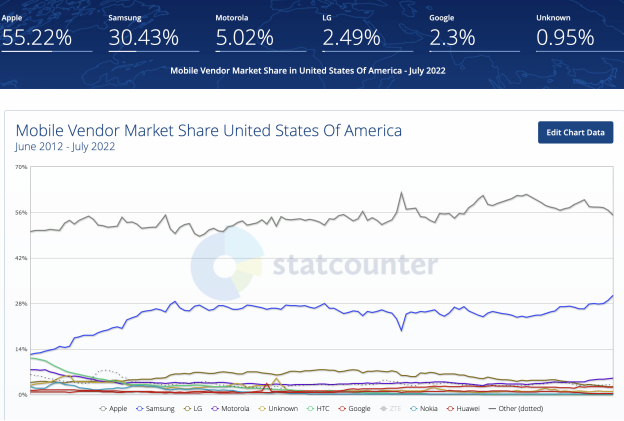

However, such a huge market with an annual revenue of nearly 75 billion US dollars and an average mobile phone price of more than 500 US dollars is almost "monopolized" by two manufacturers. In the past ten years, the US smartphone market has shown a "two-person turn" pattern. Two major manufacturers, Apple and Samsung, control 80% of the market share, while other manufacturers can only share less and less space.

Two males account for over 80% of the share

Although the statistics of various market research companies are different, no matter which data report it is, the market advantages of Apple and Samsung are unshakable. According to Statcounter data in July this year, Apple has a 55.2% share of the US smartphone market, with one company monopolizing more than half of the country. The second-ranked Samsung has a market share of 30.4%. The two major players already control as much as 85% of the market. And Canalys' statistics also show that the combined market share of the two major manufacturers exceeds 75%.

This isn't Apple's biggest quarter yet. The fourth quarter after the release of the new iPhone every year is the peak season for iPhone sales. Apple’s global market share can even surpass Samsung’s, and it enjoys the top spot in the sales list, and it is the largest in the US market. In the fourth quarter after the release of the iPhone 12 in 2020, Apple's market share in the United States even exceeded 65%.

The North American market, which includes the U.S. and Canada, is Apple's largest revenue generator. Apple’s second quarter financial report shows that the North American market revenue in the quarter totaled 37.47 billion US dollars, and Apple’s revenue contribution ratio exceeded 45%, while the European market and Greater China market revenue was 19.29 billion US dollars and 146%. One hundred million U.S. dollars.

Thanks to the hot sales of the iPhone 13 series, Apple's iPhone business revenue in the quarter was $40.66 billion, with a revenue contribution ratio of 49%. According to market research firm CounterPoint, the iPhone 13 series accounts for more than 80% of total iPhone sales. Based on Apple's US market share estimates, more than half of Apple's iPhones are shipped in the North American market.

In contrast, according to IDC's global market data in the second quarter of this year, the combined share of Apple and Samsung is only 38% (Samsung 22%, Apple 16%), while China's Xiaomi, OPPO and vivo accounted for a total of 32%. share (14%, 9% and 9%, respectively). The combined share of the three Chinese manufacturers last year was as high as 38%.

The market structure has not changed in ten years

Apple has only one competitor in the US, and that is Samsung. Samsung releases its flagship phone at the beginning of each year, and Apple releases the iPhone at the end of the third quarter. The sales peaks of the two manufacturers are also staggered, and their market shares also fluctuate. The first quarter is usually Samsung's best-selling quarter, while the fourth quarter is the best-selling season for Apple's iPhones.

The "two-person turn situation" in which the two giants dominate the U.S. market has lasted for ten years. According to Statcounter, Apple's U.S. iPhone market share crossed the 50% mark for the first time in 2012 and has never fallen below the 50% threshold since. Samsung's market share has remained above 25% since 2014, reaching a high of 34% at one point.

In the past ten years, the two major manufacturers of the US smartphone market have withdrawn one after another, and Apple and Samsung have completely lost their competitors.

In 2011, HTC ranked second in the US smartphone market with a market share of 21%, second only to the iPhone. But in the following years, the pioneer of this Android mobile phone quickly fell, the US market share fell below 1% in 2017, and finally disappeared completely in the market.

In April last year, LG officially announced its withdrawal from the smartphone market, giving up its 26-year-old mobile phone business. This mobile phone manufacturer, which once occupied the third position in the global market, relies on the carrier channel to ship low-end mobile phones in the US market, and has occupied 7% of the market share for a long time. Even in 2022, LG still has some low-end phones that continue to be sold in the open market, but the carrier channel has disappeared.

Shipping depends on the operator

Even if other markets in the world have already completed the transformation, the US smartphone market is still a market dominated by operators. Under such a market structure, even products that are not competitive in other countries' markets can obtain considerable shipments as long as they enter the US carrier channel.

Which phones are still available in the U.S. market? In the network of the four major operators, in addition to Apple and Samsung, there are only Motorola, Google Pixel and OnePlus, and occasionally Kyocera, TCL and Nokia. In the open market, there are ZTE, Sony and other brands to buy.

A direct result of the lack of competition is that Apple and Samsung phones have an absolute share of shipments in the carrier channel. A survey by market research firm Wave7 Research in early 2020 estimated that 90 percent of the phones sold by U.S. carriers in December 2019 were from Apple and Samsung. These two mobile phone brands even account for 95% of AT&T's sales.

American consumers are habitually dependent on carriers. Before 2015, Americans were used to bringing home a contract iPhone for only $199. Of course, their monthly contract bill is also over $75 (on a 2GB data plan). But after the operators removed subsidies, Americans are still used to buying mobile phones from operators and then connecting to the Internet. (There are still operators that offer subsidies for online purchases ranging from $100-200.)

Whether it can enter the operator channel directly determines the shipment volume of a mobile phone. The most direct case is that although LG mobile phones have been losing ground all over the world in the past few years, they have always maintained stable shipments in the United States, and even ranked third in the market. In the third quarter of 2020, the North American market accounted for 64% of LG's smartphone shipments. The lack of competition in the US market is also reflected in this perspective.

Before 2017, ZTE also relied on operator channels to ship a large number of low-end mobile phones. In 2016, the most prosperous year, ZTE sold 70 mobile phones at the same time on the four major operators, with an annual shipment of more than 16 million units, ranking fourth in the US market, after Apple, Samsung and LG. But it all depends on the operator. For well-known reasons, ZTE then bid farewell to the US operator platform and quickly disappeared in the US market.

|

| Motorcycle ranks fifth in the US mobile phone market above $400 |

LG quit the motorcycle adapter

Market research firm Canalys analyst Runar Bjørhovde wrote in the report that after LG announced its withdrawal from the smartphone business, Lenovo's Motorola became the biggest beneficiary, filling LG's previous mid-to-low-end mobile phone business and entering the the top three in the US market. He wrote that motorcycles have found new market opportunities by relying on carrier channels, especially focusing on prepaid and mid-range phones.

Canalys' first-quarter statistics show that Motorola's U.S. smartphone market share has finally broken through double digits. Years after its release, Google's own brand, Pixel, has finally gained a 3% market share in the United States, with quarterly shipments reaching 1.2 million units, which can be considered a firm foothold.

As a domestic brand in the United States, Motorola suffered a cliff drop after it was sold to Google in 2011. Not only did it quickly withdraw from other parts of the world, but its market share in the United States even fell below 1%. After being acquired by Lenovo, Motorola relied on the channels of Verizon and AT&T to ship products, maintaining a 3%-4% share in the United States, and finally ushered in the opportunity for LG to exit the market.

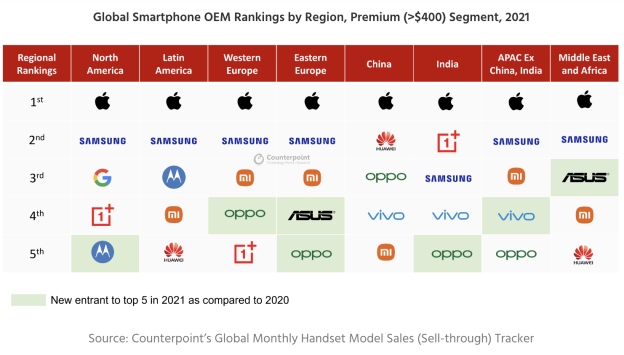

However, the number of operators' channels does not represent the trend. Statistics from CounterPoint last year show that Motorola is not even as competitive as Google and OnePlus in the US in the mid-to-high-end smartphone market that sells for more than $400. In fact, in all major regions of the world, Motorola has only entered the top three in the mid-to-high-end market in the Latin American market. (Latin America is Motorola's traditionally dominant market, especially in South American countries.)

One plus mobile phones have been sold in the United States since the first generation of products in 2012, but due to the limited channels on the official website, sales have not been able to achieve a breakthrough. With continuous efforts, OnePlus finally entered T-Mobile, the third largest operator in the United States, in 2018, and then entered the largest operator Verizon channel in 2020. Data from CounterPoint shows that OnePlus’ market share in the U.S. will break through 1% for the first time until 2021, and will continue to rise to 2% this year, comparable to Google’s Pixel shipments.

Can't play on Chinese phone

Because there are only a handful of smartphones to choose from in the US market, Android gamers like Mazumdar can only buy a wide variety of Chinese smartphones through the Internet for a long time. But he was also annoyed that his fun of playing mobile phones might not last long, because Chinese mobile phones are no longer available in the United States.

Beginning last year, major US carriers such as AT&T began to implement a whitelist mechanism to restrict access to the network for non-certified smartphone devices. The biggest impact is on users who use Chinese smartphones in the US. Mazumdar found that many domestic mobile phones such as Xiaomi and OPPO could not access the mobile network one by one, and became devices that could only be used in home Wi-Fi. In order to use Chinese mobile phones, he also uses a T-Mobile card in addition to the AT&T plan his family uses.

"In addition to AT&T blocking Chinese mobile phones, Verizon does not activate non-US mobile phones. Although T-Mobile's network access policy is still relatively loose, I don't know how long this policy will last. Moreover, 5G is not available, and Wi-Fi Calling is also No. Not to mention Huawei, the last two Huawei mobile phones I bought were Mate 30 Pro and P 30 Pro, but even if I managed to install the Google framework, the message push is very inconvenient. I have rarely bought China in the past two years. I have a mobile phone, and maybe I can't play in the future." Mazumdar said disappointedly.

Mazumdar is not satisfied with the motorcycles and OnePlus available in the US market. "The near-native system of motorcycles is very clean, but the screen and many other hardware are mediocre, the camera algorithm is not good, there are no unique functions, and the price/performance ratio is average. I have been using OnePlus since the first generation, and I will buy it in almost every generation, but After I got to the 9 series, I became disappointed and decided not to buy it anymore. Not only is the software upgrade delayed, but OxygenOS is also full of bugs, and the update and release of new firmware do not solve the old bugs.”

Chinese mobile phones are difficult to enter the United States

Although in the past ten years, ZTE, Coolpad, and TCL have all occupied a lot of shipments in the United States relying on operator channels, but relying on the channel's low-end machine volume also means that they have no brand influence. . And the truly competitive Chinese smartphone brands, Huami Blue and Green, are looking to the US market, and even if they have ambitions, they are rejected.

In January 2018, Huawei and AT&T reached a sales cooperation for the Mate 10 series, but at the last moment before the release of the new product, it was forced by the US government to stop it. The huge upfront marketing expenses that Huawei invested in this were all in vain. Yu Chengdong sighed with anger and helplessness on the CES stage, "Huawei's inability to enter the US operator's network is a major loss for Huawei, a loss for operators, and a loss for American consumers."

As commented by the US technology blog 9to5Google, the US smartphone market seems to be quite different from the rest of the world. Chinese smartphone makers such as OPPO and Xiaomi do not sell in the United States, and this situation will not change in the next few years.

This is the most profitable market in the world, with annual sales of nearly 75 billion US dollars and an average sales price of more than 500 US dollars. Apple and Samsung make a lot of money. This is also the most closed market in the world. Apple and Samsung dominate the market share of 80%. Entering the operator channel means getting a shipment guarantee. For Chinese manufacturers, this is an unattainable castle.

0 Comments