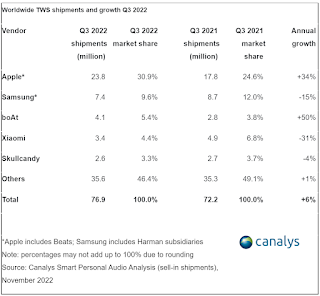

According to the most recent Canalys projections, the worldwide smart personal audio market fell for the second time in a row in Q3 2022, with sales down 4% to 113.6 million units. TWS was the only category to rise (including wireless earbuds and wireless headphones), with a 6% increase to 76.9 million units in the quarter. Apple (including Beats) maintained its dominance with the release of the second-generation AirPods Pro, which resulted in a 34% rise in shipments and a 31% market share. Despite the release of the new Galaxy Buds2 Pro, Samsung (including Harman subsidiaries) saw a 15% drop in shipments. BoAt, a local seller in India, finished third with a 5% market share, but its growth rate decreased to 50%. Xiaomi and Skullcandy placed in fourth and fifth place, with 4% and 3% of the market, respectively.

Apple's release of the AirPods Pro 2 gave the vendor a boost. It shipped 4.2 million AirPods, accounting for 20% of total shipments. Despite releasing its latest flagship model, Samsung encountered a different situation, with Galaxy Buds shipments falling by 25%.

According to Canalys Research Analyst Sherry Jin, the late August shipment date and higher selling price of the Galaxy Buds2 Pro hindered the Galaxy Bud series' market performance in Q3. In Q3, Samsung also adopted a more conservative approach to packaging in order to maintain the flagship positioning of the Pro series in its launch quarter.

According to Canalys Analyst Ashweej Aithal, local rulers supporting these low-cost gadgets and active market education would hasten the market's shift to TWS. However, the overall market's single-digit growth rate may represent current market demand and consumption peaking. When TWS shipments reach 10 million, local customers will seek smartphones with higher quality features, such as greater audio, longer battery life, and ANC functionalities, sooner or later. Vendors must therefore be alert to market changes in order to supply better devices and alter future shipments in order to maintain healthy inventory levels.

In the third quarter of 2022, audio-centric brands like as Sony, Jabra, and JBL (all of which are part of Samsung's Harman division) employed aggressive discounting across channels to maintain shipping levels, greatly undermining the market performance of value-for-money brands. However, the market value growth for these brands have been largely flat, reflecting the macroeconomic difficulties that vendors are facing. Market performance may continue to deteriorate in Q4. Most merchants will be more careful in comparison to last year's shipment numbers, trying to prevent excessive inventory levels. Aggressive discounting will only provide temporary relief. To keep share and thrive in the future, vendors must go deep and extend their user bases while maintaining their existing advantages.

0 Comments