According to recent research from Counterpoint’s Foundry and AP/SoC Service, a smartphone application processor (AP)/system on chip (SoC) shipments grew by 6% year-on-year in the third quarter of 2021. Additionally, 5G smartphone SoC shipments saw a significant increase of almost two times compared to the same period in 2020.

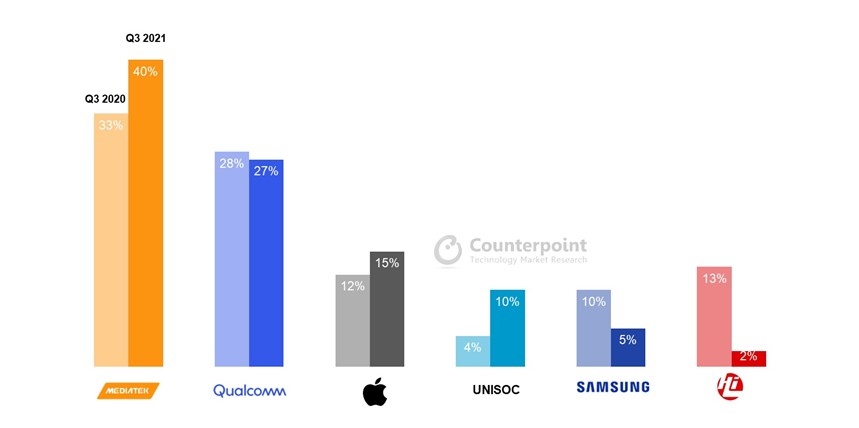

MediaTek led the smartphone SoC market with a 40% share, thanks to a competitive 5G SoC and high demand for its 4G SoC. The company’s revenues grew sequentially as the mix of its mid-end and high-end SoC portfolios grew. MediaTek’s average selling price (ASP) is expected to continue increasing due to the launch of flagship products in the first quarter of 2022 and an increase in chipset prices starting in the fourth quarter of 2021.

Despite the growth of 5G smartphone SoCs, 4G chipsets remained in high demand due to ongoing shortages which have affected 4G SoCs more. Research Director Dale Gai noted that these shortages have had a significant impact on the market.

| ||

| Global Smartphone AP/SoC Shipments Market Share, Q3 2020 vs Q3 2021 |

In addition to MediaTek’s strong performance in the smartphone AP/SoC market, Qualcomm also saw growth in the third quarter of 2021. Research Analyst Parv Sharma noted that Qualcomm’s smartphone SoC shipments grew both quarter-on-quarter and year-on-year during this time period.

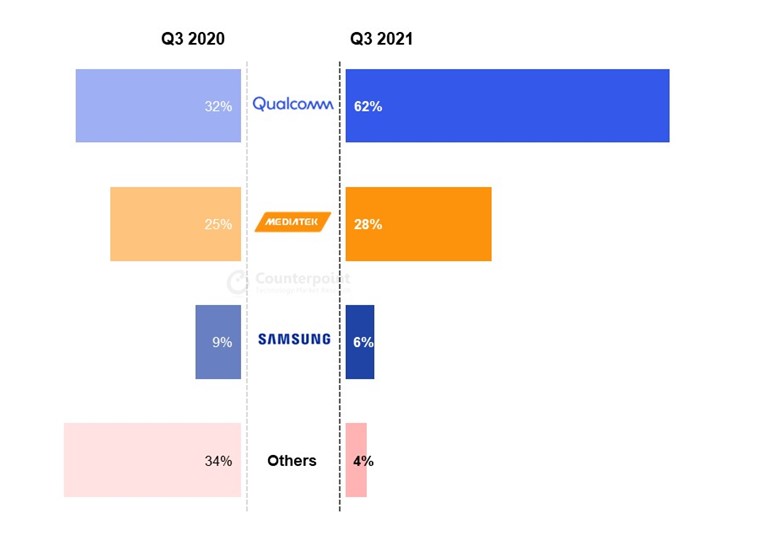

One key factor in Qualcomm’s revenue growth was its ability to dual-source manufacturing of key components, including the Snapdragon 800 series SoCs and its premium 5G modem. This helped Qualcomm lead the 5G baseband market with a 62% share, thanks in part to its success in winning the 5G baseband modem chipset for the Apple iPhone 13 series and strong demand for its complete 5G SoC chipsets.

Meanwhile, MediaTek saw strong momentum from its Dimensity 700 and 800 series in the low-mid segment. Overall, both MediaTek and Qualcomm were major players in the smartphone AP/SoC market in Q3 2021, with MediaTek leading the way and Qualcomm seeing strong growth.

| ||

| Global 5G Smartphone Baseband Shipments Market Share, Q3 2020 vs Q3 2021 |

MediaTek dominated the smartphone system-on-chip (SoC) market in the third quarter of 2021 with a 40% share. Its success was due in part to its strong performance in the low-mid segment 5G portfolio and its LTE SoCs. Qualcomm saw 9% sequential growth thanks to dual sourcing from foundries and dominated the 5G baseband modem shipments with a 62% share. Apple maintained its third position in the market with a 15% share, which is expected to grow further in the fourth quarter due to the launch of the iPhone 13 and the festive season, although component shortages may impact sales.

UNISOC saw shipment growth for the third consecutive quarter in Q3 2021, with its market share entering double digits at 10%. The company has expanded its customer base with design wins from major OEMs like HONOR, realme, Motorola, ZTE, and Transsion, as well as a win in Samsung’s Galaxy A series. Samsung Exynos slipped to fifth place with a 5% share as it is in the process of rejigging its smartphone portfolio strategy by both in-sourcing and outsourcing to Chinese original design manufacturers (ODMs). This has led to growing shares for MediaTek and Qualcomm across Samsung’s smartphone portfolio. HiSilicon, meanwhile, has been impacted by the US trade ban, resulting in Huawei being unable to manufacture HiSilicon Kirin chipsets and relying on Qualcomm SoCs for its latest series, albeit limited to 4G capabilities.

0 Comments