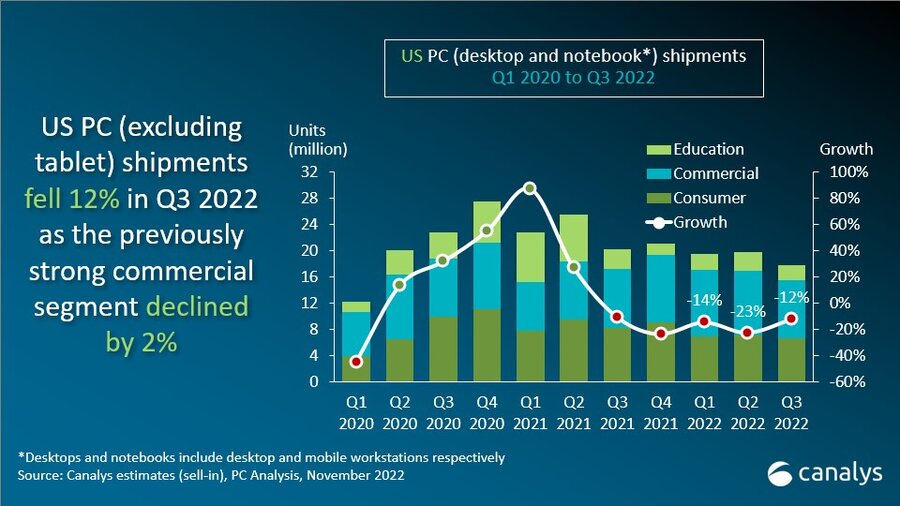

In the third quarter of 2022, shipments of desktops, laptops, and workstations in the United States declined 12% year on year to 17.8 million units. Notebook sales fell 14%, the most of any category, as cautious business expenditure combined with a dip in consumer and education spending. Desktops increased by 1% in the third quarter as the category recovers from pandemic-era reductions. Despite the increased promotional activity, tablet sales declined by 1% as inflation reduced demand. Commercial demand, which had been strong in recent quarters, decreased in Q3, with the category falling by 2%.

According to Brian Lynch, a Canalys Research Analyst, the US PC industry was already in a prolonged phase of contraction due to inflation and saturation in both consumer and academic demand. The formerly robust commercial category has begun to fade, with 2022 seeing its first year-on-year fall. Both the ISM Services and Manufacturing Purchasing Managers Indexes have been continuously declining since late 2021, and they are now at their lowest levels since the epidemic began. Inflationary pressure, interest rate rises, and cost-cutting initiatives are beginning to limit IT managers' expenditures. While overall employment remains high, the commencement of layoffs in the technology and banking industries is an early indication that business spending on PCs may become even more cautious in the first half of 2023. Nonetheless, due to the essential role of PCs in enabling trends such as hybrid work and digital transformation, the long-term forecast remains optimistic. In the medium run, device lifespans will be prolonged as businesses manage the present economic turmoil. The US PC market will experience further difficulties in the future. Despite the Q4 Christmas season, the market will continue to fall. Consumers who are pressed for cash will reduce their expenditure on high-tech items. As the holiday season approaches, retailers have increased sales in recent months to create a place for new product launches. However, overall retail stocks continue to expand faster than sales. The education sector will begin a sluggish rebound in 2023, although the majority of gadget refreshes are now expected in 2024. Education funding is stable, but schools are projected to want higher-specified technology at greater prices. Given the convergence of these variables, we anticipate additional decreases in US PC shipments in the first half of 2023.

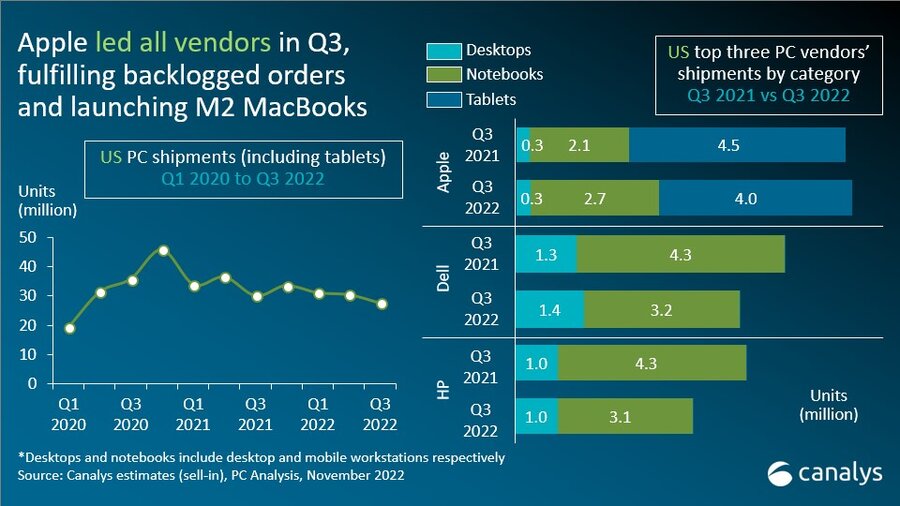

Dell maintained its lead in the US desktop and notebook market in the third quarter, with a 26% market share, although shipments were down 17% year on year. HP delivered 4.1 million systems to finish second, but had the greatest drop of the top five suppliers, with shipments falling 23%. Apple fared well in Q3 with 26% growth, benefiting from backlogged orders from a supply-constrained Q2 and launching new M2 smartphones. Lenovo dropped to the fourth position due to difficulties in the commercial area. Acer landed in fifth place, with a 14% increase.

With a 41% market share, Apple maintained its long-held top position in the US tablet industry. In recent quarters, premium tablets have struggled with price-sensitive buyers, whilst inexpensive tablets have done well. Second-placed Amazon gained a 27% market share and increased shipments by 20% as a result of a successful Prime Day in July. Samsung landed in third place with 1.6 million shipments, a 13% decrease year on year. TCL's rapid ascent continued with 133% growth as it intensified marketing and branding efforts in the region, while Microsoft rounded out the top five with a 12% drop.

.png)

0 Comments